NEWS

USPTO to Charge Extra for Late Continuation Applications — Don’t Get Caught by the Six- and Nine-Year Traps

The U.S. Patent and Trademark Office (USPTO) just rolled out a new “late-filing penalty” for continuation applications that come in six or nine years after the earliest priority date in the family.

This isn’t just a cash grab. The USPTO has likely decided that ultra-late continuations — sometimes filed a decade after the original application — are being used to keep claim scope in flux long after the market has settled. That makes life unpredictable for competitors, and the Office is signaling it wants to curb that practice.

What Is a Continuation Application and Why It Matters

First, in case you need a reminder of what a continuation application is, think of it as keeping the door open. You’ve got an original patent application on file. A continuation* is a new application that uses the same description but lets you go after different claims — broader, narrower, or just different angles. The beauty is you keep the original filing date, which is gold in patent land.

USPTO’s New Late Continuation Filing Surcharge Explained

The USPTO will now charge additional fees for continuation applications filed six or nine years after the earliest priority date in the patent family. The longer you wait, the more you pay.

New USPTO Continuation Fees: Six-Year and Nine-Year Penalties

The new price of waiting

- Large entities: $2,700 (six years) / $4,000 (nine years)

- Small entities: $1,080 (six years) / $1,600 (nine years)

- Micro entities: $540 (six years) / $800 (nine years)

These numbers aren’t small, and they’re designed to get your attention. If you want to avoid paying them, you’ll need to plan ahead.

Why the Six-Year Deadline Is a Real Risk in Slow Patent Prosecution

This matters more than you think because patent prosecution is slow — sometimes glacial. In complex tech, pharma, or life sciences, it’s normal to be past the six-year mark before your first U.S. application is even allowed. File your continuation then, and you’re automatically in surcharge territory.

Questions to ask before you hit six or nine years

- Is this a blockbuster product? Keep a continuation pending — it’s the best way to adapt and keep competitors in check.

- Is anyone sniffing around your market? Continuations let you tailor claims midstream in litigation.

- Do you have features you never claimed? File early and lock them in without paying the extra fee.

- Did the USPTO restrict your application? That means they spotted more than one invention. File a divisional before the clock runs out.

Divisional Applications and Restriction Requirements: Don’t Miss the Window

If the USPTO issued a restriction requirement, that’s often a sign you have additional claim scope available. A timely divisional application can preserve those rights without triggering late continuation surcharges.

Six-Year vs. Nine-Year Continuation Strategy: A Practical Timeline

Goal: Keep strategic patent options alive without paying the USPTO’s new “late continuation” surcharges.

At 5½ Years from Earliest Priority Date

- Review portfolio: Identify any cases where you might want broader or different claims.

- Flag restrictions: Look for USPTO restriction requirements — these often signal unclaimed inventions.

- Decide early: File continuations/divisionals now if there’s any chance you’ll want them.

Six-Year Mark (Penalty threshold #1)

- If you file after today → you pay $2,700 / $1,080 / $540 (large/small/micro).

- If the case is valuable or the market is hot, consider filing before today to avoid this first surcharge.

Between Six and Nine Years

- Monitor product and market developments closely.

- Keep at least one application alive for critical cases.

Nine-Year Mark (Penalty threshold #2)

- Filing now costs $4,000 / $1,600 / $800.

- By this point, you should already have filed anything you need — paying this is last-resort territory.

How to Avoid USPTO Late Continuation Fees

Don’t let allowance dictate when you file continuations. Let strategy dictate — and let the clock tell you when it’s time to move.

Let Strategy — Not Allowance — Drive Continuation Timing

The six- and nine-year deadlines are now hard markers. The USPTO’s message is clear: if you’re keeping applications alive deep into the timeline, you’re going to need to pay for it. For everyone else, planning ahead avoids the surcharge and keeps your strategic options intact.

* for more information on continuation applications, check our FAQ page on patent prosecution. The question on continuations is fifth from the bottom.

If USPTO policy towards different entity sizes is of interest, check out these articles: When Trying to Save Money May Cost More

Do USPTO Fee Discounts Hurt Inventors’ Chances? Probably Not.

From Brain Scans to Rain Scans: How Tumor-Detecting AI Is Predicting the Weather

In a twist that sounds like science fiction, researchers in Xi’an, China have taken artificial intelligence designed to find tumors in brain scans and taught it to forecast the weather – fast. As a result, they can now generate five-day regional forecasts almost instantly.

In a twist that sounds like science fiction, researchers in Xi’an, China have taken artificial intelligence designed to find tumors in brain scans and taught it to forecast the weather – fast. As a result, they can now generate five-day regional forecasts almost instantly.

The secret lies in deep learning models that were originally built to spot tiny anomalies in medical images. However, by retraining these systems on historic weather data, the team discovered they could recognize atmospheric patterns. More importantly, they did so with exceptional accuracy—even in areas where weather data is scarce.

At the heart of the method is something called cascade prediction. Instead of trying to predict all five days at once, the AI breaks the job into smaller chunks.

In this way it predicts shorter time spans and stacks the results. Consequently, this clever sequencing cuts down cumulative errors, boosting accuracy by nearly 20% compared to standard techniques.

To make it even smarter, the system adds what the researchers call “learnable Gaussian noise”. This is a fancy way of saying the AI adjusts for local quirks in the weather. For example, the model trained on 70 different weather variables collected every six hours between 2007 and 2016. Notably, it managed to show particularly strong performance across East Asia.

Traditional high-accuracy weather models are computationally heavy and often out of reach for smaller meteorological services. This approach is faster, cheaper, and far more accessible; opening the door for better forecasting in places that need it most.

Sometimes, innovation comes from thinking sideways: in this case, turning a brain tumor hunter into a rainstorm spotter.

Link here: https://studyfinds.org/ai-predict-accurate-weather-forecast-brain-scan-tech/

Bored Apes, Confused Courts, and the Question of Whether NFTs Are “Goods”

Picture source: https://boredapeyachtclub.com/

When Trademark Law Meets Web3 and Cartoon Apes

If you’ve ever wondered whether the law treats an NFT like a Beanie Baby, a baseball card, or just a bunch of ones and zeros, the Ninth Circuit just gave us an answer: yes, NFTs are “goods” under the Lanham Act.

That little detail matters because it opens the door for trademark law to march right into Web3. And in this case, the march was led by Yuga Labs, creators of the Bored Ape Yacht Club (BAYC).

You know, the cartoon apes that double as pricey status symbols, social club memberships, and occasionally, celebrity conversation pieces.

Yuga Labs vs. RR/BAYC: How the Dispute Over Bored Ape NFTs Began

On the other side of the ring: Ryder Ripps and Jeremy Cahen, who launched their own “Ryder Ripps Bored Ape Yacht Club” (RR/BAYC) using the same ape images and IDs, slapped “Bored Ape Yacht Club” on the smart contract name, and claimed it was all satire to protest Yuga’s alleged flirtations with bad symbolism and worse politics.

District Court Ruling: Trademark Infringement, Willfulness, and Damages

Yuga sued for trademark infringement, cybersquatting, and a few other greatest hits. The district court handed Yuga a win on the big-ticket claims, called it willful infringement, and hit the defendants with profit disgorgement, statutory damages, and attorneys’ fees — plus a permanent injunction for good measure.

The Ninth Circuit’s Take: What It Agreed With—and What It Didn’t

But the Ninth Circuit wasn’t buying the “open-and-shut” part. Here’s the quick breakdown:

- NFTs are goods — they’re bought and sold in online marketplaces, confer perks, and have value independent of any “tangible” packaging.

- BAYC marks are enforceable — Yuga didn’t lose them by selling NFTs, granting broad art rights, or allegedly failing to police the brand.

- Fair use and First Amendment defenses failed — calling it satire doesn’t help if you’re actually using the marks to sell your own product.

Why Consumer Confusion Still Matters in NFT Trademark Cases

But the district court skipped a thorough confusion analysis. Trademark infringement isn’t just “we see the same name.” You have to walk through the Sleekcraft factors, and the Ninth Circuit said, “Nope, you didn’t do that.” So back it goes.

Cybersquatting Claims and Why They Failed

Cybersquatting? Not this time. “rrbayc.com” wasn’t close enough to “BAYC”. “apemarket.com” wasn’t confusingly similar to “Bored Ape”. And Yuga abandoned “Ape” as a standalone mark.

What Happened to the Defendants’ DMCA and Copyright Counterclaims

The defendant’s DMCA claims fizzled because even if Yuga was sloppy in takedown notices, it wasn’t a bad-faith misrepresentation. And the copyright declaratory judgment request was dismissed with prejudice.

What This Decision Means for NFTs, Trademarks, and “Satire” Projects

This isn’t just about cartoon apes. The Ninth Circuit just solidified that NFTs are commercial goods for trademark purposes — so yes, the name you give your pixelated penguin project matters. But even if you own the mark, you don’t get to skip the hard work of proving consumer confusion.

And for those trying to wrap satire, protest, or just-for-laughs into a money-making NFT drop? Courts aren’t amused when the “joke” looks exactly like the thing you’re “joking” about and you’re charging admission at the door.

For more articles on trademark hijinks, check out: Trump Too Small Trademark Is Not First Amendment Violation

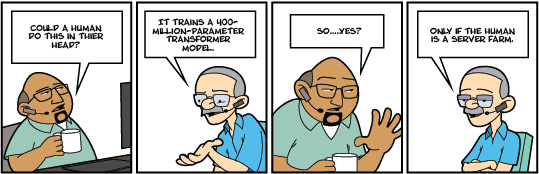

USPTO Clarifies AI and Machine Learning Patent Eligibility

Background: USPTO Issues New AI Eligibility Memo

The USPTO issued a memorandum on Aug 2, 2025. This was to help examiners assess subject matter eligibility in software-related inventions, especially those involving AI and machine learning. The memo does not change existing rules. It only reinforces current guidance in the MPEP and the 2024 AI Subject Matter Eligibility Update.

Step 2A Prong One: Identifying Judicial Exceptions

Examiners must determine if claims recite a judicial exception (abstract ideas, laws of nature, or natural phenomena). Special focus is given to the mental process category. The stress is that only processes that can practically be performed by the human mind count as abstract ideas. Claims that merely “involve” but do not “recite” such exceptions remain eligible. (Check the end of this article if you want help understanding between involving and reciting)

Step 2A Prong Two: Integrating Exceptions into Practical Applications

If a judicial exception is recited, examiners must evaluate whether the claim as a whole integrates it into a practical application.

This includes checking if it improves computer functioning or another technical field. It can’t just tell a computer to “apply it.”

Guidance on Section 101 Rejections

Examiners should avoid oversimplifying claims and only issue 101 rejections when ineligibility is more likely than not.

(101 rejections cover subject matter that the law doesn’t allow patents on, like ideas that are too abstract or laws of nature, for example)

Full Examination Still Required

The memo reiterates that a complete examination must address all statutory requirements. This includes Sections 101, 102, 103, and 112, and must be done in the first Office action.

USPTO Training and AI-Specific Examples

The USPTO also points examiners to ongoing training materials and illustrative examples, including AI-focused scenarios, to guide eligibility analysis.

Takeaway: Emphasis on Real Technological Improvements

In short, the memo emphasizes careful distinctions between abstract ideas and genuine technological improvements, particularly in AI and machine learning inventions.

Here is a link to the full article:

https://www.uspto.gov/sites/default/files/documents/memo-101-20250804.pdf

PS: These memos are guidelines, not mandates.

For some other articles covering the ongoing debate over AI and Patent Eligibility, see these articles:

When a Patent Case Is Really a Personhood Case

Who Gets Credit When AI Invents? A Look at the History—and Future—of Inventorship

China Finally Gets Serious About Fair Play in the Marketplace

Why China’s Revised Anti-Unfair Competition Law Is a Big Deal

For years, China’s business environment has been a bit like the Wild West—only with more knockoffs, keyword hijacking, and fake online reviews than a shady eBay seller convention. If you built a brand, it was open season for imitators to leech off your reputation. Search for your product online, and odds are you’d find some “similar” listing piggybacking off your trademark as a keyword. And if you complained? Well, good luck with that.

That’s why the newly revised Anti-Unfair Competition Law—passed June 27, 2025, and taking effect October 15—marks a pretty significant pivot.

This isn’t just another set of rule tweaks. It’s a sign that Beijing has recognized several big realities.

China’s Old Unfair Competition Rules Weren’t Built for the Digital Economy

The old law was written for an analog economy, not the algorithmic one we live in now. Back in the ’90s, unfair competition was about copying product packaging or running misleading ads.

Fast forward to today, and the battlefield is dominated by platform algorithms, data scraping, and SEO manipulation. The old law simply wasn’t built to handle things like “keyword squatting” or “comment farming,” and bad actors took full advantage.

Why Fair Competition Matters to China’s Digital Economy Goals

China’s digital economy can’t thrive if no one trusts the playing field. The government wants to be a global leader in AI, e-commerce, and fintech. But you can’t lure serious investment—domestic or foreign—if innovators fear their ideas will be swiped and their traffic diverted by clever cheats. Tightening the rules helps build credibility with both entrepreneurs and trading partners.

Protecting SMEs From Platform Power and Predatory Practices

Small and medium-sized enterprises were getting crushed. Large platforms and corporations have been using their clout to force predatory payment terms, undercut prices below cost, and lock smaller players into unfair conditions. The revised law directly tackles this “payment term bullying” and abusive platform rule-making. That’s not just good policy—it’s survival gear for keeping the SME sector alive.

Data Rights Take Center Stage Under China’s New Competition Law

Data is the new gold, and China is fencing it in. In the old days, you stole a competitor’s design. Today, you siphon their user data. The law now treats data rights as a central part of fair competition—banning unauthorized harvesting, coercive acquisition, and the weaponizing of platform algorithms to kneecap rivals.

What the New Law Signals About China’s Economic Priorities

This isn’t China suddenly finding religion on fair play. It’s about keeping their digital economy competitive, making sure innovation happens in the open market—not in the shadows. And it’s a reminder that when governments feel the growth engine sputtering, they’re suddenly a lot more interested in protecting the people who actually build the engines.

What Businesses Operating in China Need to Do Before October 15

For companies doing business in China, this is both a shield and a warning. It’s a shield against bad-faith actors who’ve been gaming the system for years. But it’s also a warning that compliance just got more complicated—and “we didn’t know that was illegal” won’t fly after October 15.

For some more articles on China’s patent landscape, try these: Good News – Chinese Trademark Office Starting to Enforce Against Squatters

When “Close Enough” Isn’t Good Enough: Colibri v. Medtronic and the Push–Pull of Patent Law

The Doctrine of Equivalents: When Literal Infringement Isn’t Required

Patent law has its own version of “close enough,” called the Doctrine of Equivalents (DOE). It says that even if a product or method doesn’t match the exact words of a patent claim, it can still infringe if it does substantially the same thing, in substantially the same way, to get substantially the same result. For example, your neighbor promised not to build a “fence”. Then he puts up a 10-foot-high “hedge wall” that blocks your view just the same. Because he accomplished the same result, he might still be in trouble.

Prosecution History Estoppel: You Can’t Take Back What You Gave Up

But there’s a counterweight to this rule: Prosecution History Estoppel (PHE). Imagine you narrow your patent claim to get it approved by the Patent office. Maybe you remove certain versions or features. You can’t turn around later and use the DOE to grab back what you gave up. In other words: you made your bed, now you lie in it.

That’s the tug-of-war at the heart of Colibri Heart Valve LLC v. Medtronic Corevalve, LLC.

The Colibri Patent and the Two Deployment Methods

Colibri’s patent covered a heart valve that could be partially deployed, then “recaptured” and repositioned if it wasn’t in quite the right spot — a surgical do-over button. The patent described two ways to deploy the valve:

- Push it out from inside a sheath.

- Retract the sheath to uncover it.

Claim Cancellation During Prosecution Changes the Playing Field

During patent prosecution, Colibri dropped all claims covering the “retract” method after the Patent Office said they weren’t properly supported. That left only the “push” method in the issued patent.

The Accused Device and the Jury’s $106 Million Verdict

Medtronic’s device used a combination of both pushing and retracting to deploy its valve. Colibri argued, “That’s close enough — DOE!” and a jury agreed, awarding $106 million in damages.

The Federal Circuit Applies Prosecution History Estoppel

The Federal Circuit wasn’t buying it. Judge Taranto, writing for the panel, said: Cancelling the “retraction” claim narrowed the scope of the remaining claims. The cancelled and retained claims were so closely related that giving up one told the world you weren’t claiming that territory anymore. PHE barred Colibri from getting that territory back through DOE, even if their remaining claim language wasn’t literally changed.

The Bigger Lesson for Patent Owners and Prosecutors

This case is a reminder that the DOE and PHE are like a patent-law see-saw: the more you give up during prosecution, the less you can later claim as “equivalent.” Once you cancel a claim to get your patent issued, the courts may see it as a binding surrender, even if you think your other claims are worded differently.

For inventors and companies, the takeaway is simple: decisions made during prosecution can come back years later in court — and they can make or break a case worth nine figures.

For a related article on the doctrine of equivalents, see: Doctrine of Equivalents

Fair Use and AI Training: Buy It or Bye-Bye

A recent court decision gave AI developers a roadmap for staying out of copyright trouble—and a big flashing warning sign for what not to do.

The case: Anthropic, the folks behind Claude, trained its AI on a huge stash of books. Some were bought, scanned, and stored. Others came from pirate sites. You can guess where this is going.

The court split the baby:

- Bought and scanned books? Fair use. Transformative. Like teaching a student to write—new output, not copies. Destroy the paper version, keep the searchable digital version, you’re fine.

- Pirated books? Not fair use. Doesn’t matter if you never train on them. If you’re holding unauthorized copies, you’re replacing legitimate sales. That’s infringement, and damages are on the table.

For AI training, the message is simple: If you want fair use on your side, start with legally obtained material. Buy it, borrow it, license it—just don’t snatch it from the high seas of the internet.

Because in this court’s eyes, training on a legit copy is like learning from a library book. Training on a stolen copy? That’s like breaking into the library at night.

At the end of the day: Pay for your inputs. Your model will be smarter—and so will you.

Earlier articles on AI and copyrights: AI Training, Fair Use, and Meta